Recent Posts

Water Damage after a fire

8/8/2023 (Permalink)

Many think of the immediate damage that needs to be restored and repaired after a fire as burnt and sooty. There is a damage that many do not think of: water from fighting a fire. Many building materials when wet, and become saturated like when a fire is fought, can cause mold to grow, wood to rot, and issues to arise long after. Wiring can be exposed and damaged, mold spores can begin to grow within 24 hours, and eat away drywall, flooring, and wood. The damage caused can affect the structural integrity of your home. Never enter your home until a professional can inspect your home’s roof, ceilings, walls, flooring, and electrical wiring. When able to enter, take pictures of everything to document current damage, and document damage often for any mold growth or further damage. Always contact your insurance agent and then the fire and water restoration professionals at SERVPRO.

Why SERVPRO?

8/2/2023 (Permalink)

When facing the aftermath of a disaster, selecting a restoration company that you can rely on becomes paramount to ensuring a seamless recovery process. SERVPRO continues to set the industry standard with its unparalleled dedication to excellence, state-of-the-art technology, and unwavering commitment to customer satisfaction.

Our commitment to exceptional service has earned SERVPRO numerous accolades and recognition as a trusted industry leader. When you choose SERVPRO, you're choosing a partner who is invested in your property's recovery and your peace of mind. We take pride in helping our clients navigate through disasters with care, transparency, and utmost professionalism.

When you're faced with the aftermath of a disaster, don't settle for anything less than the best. Choose SERVPRO for restoration services that exceed expectations and restore your property to its preloss condition with precision and compassion.

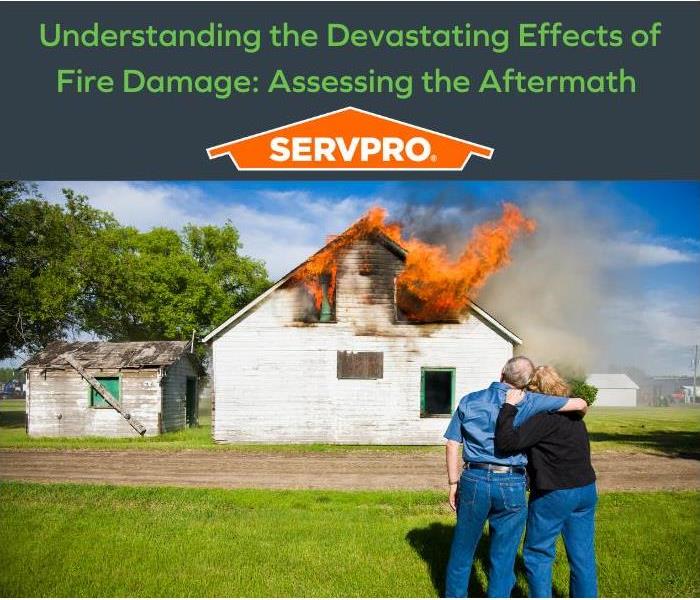

Understanding the Devastating Effects of Fire Damage: Assessing the Aftermath

8/1/2023 (Permalink)

Fire has the potential to destroy your property, burning appliances and devastating effects. Fires don’t just cause one type of damage, there is not only damage done by fire, but by heat, smoke, and water. But besides physical damage, there is the emotional distress that comes with it. You lose your residence, your place of security, safety, and comfort. Relocating and rebuilding can be emotionally exhausting, many often experience bitterness, disbelief, and sadness, before coming to a stage of acceptance, and begin moving forward.

Before reaching a stage of acceptance it is important to take care of yourself, and practice self-care. It’s important to remember to keep a routine, maintain a normal sleep cycle, and use the community support available. SERVPRO is here to help you navigate the confusing time after a fire, helping ease the burden.

Weathering the Storm: Understanding the Impact of Storm Damage

8/1/2023 (Permalink)

Storms can strike unexpectedly, leaving a trail of destruction in their wake. From powerful hurricanes and thunderstorms to relentless blizzards and flash floods, Mother Nature's fury can wreak havoc on homes and businesses alike. Understanding the impact of storm damage is crucial in preparing for such eventualities and seeking timely restoration solutions.

Storm damage comes in various forms, including structural damage, water intrusion, fallen trees, roof leaks, and electrical hazards. These elements can compromise the safety and integrity of buildings, posing risks to occupants and valuable assets. Beyond the visible damage, storms can also leave behind insidious issues like mold growth due to prolonged moisture exposure.

Prompt action is key to mitigating storm damage's long-term effects. Engaging professional storm damage restoration services, like SERVPRO, can make all the difference in minimizing losses and facilitating a speedy recovery. These experts are equipped with the knowledge, tools, and experience to assess the extent of damage, address safety hazards, and begin the restoration process efficiently.

Preparedness is equally vital in dealing with storm damage. Simple steps like securing outdoor items, reinforcing doors and windows, and having an emergency kit ready can significantly reduce potential risks. Regular maintenance and inspection of properties can also help identify weak points and address them before a storm strikes.

Storm damage is a powerful reminder of the uncontrollable forces of nature. By understanding its impact and embracing preparedness, individuals and businesses can better weather the storm's aftermath and emerge stronger in the face of adversity. Remember, in times of crisis, professional storm damage restoration services stand ready to help restore what matters most.

How to Prepare for a Snow Storm

8/29/2022 (Permalink)

It is typical to have some preparation for snowstorms, and there are great ways to prepare and make sure that you and your family are being as careful and cautious as possible.

Communication

Communicating with your family about the snowstorm is a great way to make sure that you are all on the same page. When you are all on the same page about what to do and what not to do, it will be easier to make sure that the entirety of the snowstorm goes smoothly.

Insulation

Make sure that your Insulation is installed correctly. This will make a huge difference when temperatures drop, and if it is not installed properly, it will be horrible once you realize that it wasn’t and you can’t have anyone come out to look at it because of the road conditions.

Storm Windows

The installation of storm windows can help to keep cold air out immensely, and if this is not obtainable, covering them with plastic is a good alternative.

Fireplace Check

If you have a fireplace, it is vital that you are getting it checked semi-regularly. This will make sure that you have no issues when temperatures drop significantly and the weather gets nasty outside. Once you know that your fireplace is in great condition, stocking up on wood or coal is a great way to ensure that you will have as much heat as possible during the storm.

Radio/Television

It is important during the entirety of any storm to stay updated and vigilant in regard to what is happening. The best way of doing this is to always have the TV or the radio. This will help you to stay updated and make sure that you are two steps ahead of the storm and prepared for when it comes.

There is a multitude of ways to prepare for snowstorms and there is always a chance that there may be some damage to your home, and in that case, SERVPRO is here to help you and your family 24/7.

How to Be Prepared for a Heavy Rain Storm

7/27/2022 (Permalink)

Rain has been known to make an appearance all throughout the year in Northeast Ohio, so it never hurts to get a refresher on how to prepare. Ohio can have unpredictable weather, but if you know a storm is coming, you should take some time to prepare for it.

- Inspect your roof: Look for any missing shingles or other areas of concern that may cause a leak. The last thing you want is a leaky roof over your head. While you are up there, it might be a good idea to clear out your gutters so the water can flow better.

- Close All of Your Doors and Windows: As silly as it may sound, sometimes we need to be reminded to do the simple things. Don't forget to check that your car windows are shut as well.

- Look at the Lawn: If the weather is nice leading up to the storm, you probably have some miscellaneous items in your yard. Make sure they are stored safely. Don’t forget to put your umbrellas down!

- Check the Sump Pump: Make sure that it is in tip-top shape so it can shine during the storm. It is also a good idea to have a backup battery in case the power goes out.

Storms are known to cause severe damage, which makes preparation so important. By completing the following steps, you are on your way to getting through a storm safely. If the storm ever takes a turn for the worse, SERVPRO is here to help. Call us, no matter what time of day, and we will be there to help.

Being Proactive in the Event of a Power Outage

7/27/2022 (Permalink)

Power outages are not as common as rain, or even snow, but they still have a chance of happening. In the occurrence of a potential power outage, you need to be proactive and prepared. Here are some things to consider during the event of a power outage.

Keep freezers and refrigerators closed

It’s important to make sure you are not opening your refrigerator or freezer in the event of a power outage. Your refrigerator will typically keep food cool for four hours. Your freezer will keep food cold for around 48 hours. You may want to use coolers with ice for other items that you may need to keep cold.

When you’re consuming food, make sure you’re consuming food that does not require refrigeration or freezing.

Do not use a gas stove to heat your home

By not using a gas stove to heat your home, you are preventing the chance of carbon monoxide poisoning.

Check on your neighbors and other loved ones

It’s best to find out how others you care about, and others in your community are holding up. This is important for the elderly as well as those who are young. These individuals are more vulnerable to temperatures.

Disconnect any appliances and electronics

Doing this will help you to prevent any electrical surges and any other damage that could possibly be preventable.

What a Good Emergency Ready Plan Will Look Like For Your Business

7/27/2022 (Permalink)

Emergency Ready Plans are the best way to prevent any disasters from happening in your business and are a great way to be one step ahead of any mishaps. Our SERVPRO Emergency Ready Plan is a great way to make sure your business is staying proactive in situations where you will need some cushion. This plan includes many advantages and will be beneficial in the long run for your business.

A No-Cost Assessment of Your Facility

No need to allocate funds, giving you great value at no cost.

A Concise Profile Document

It takes just a short time to complete the profile but could save long hours of time and effort if ever needed.

A Guide to Help You to Get Back Into Your Building

Having an immediate plan of action can help minimize the downtime to your business in an emergency.

Establishes Your Local SERVPRO As Your Disaster Mitigation

You have a provider that is recognized as an industry leader and is close by.

Identification of the Line of Command

You can save time and money as we begin the work of mitigating the damage.

Provides Facility Details

Such as shut-off valve locations, priority areas, and priority contact information. You’ll have a quick reference of what to do, how to do it, and who to call ahead of an emergency.

Easier Insurance Claims Process

SERVPRO will help you navigate the insurance claims process and coordinate the necessary paperwork for a quicker, easier experience.

Why Choose SERVPRO for Mold Remediation

7/27/2022 (Permalink)

Mold is not uncommon and can happen at any time. Whenever you are in a mold remediation crisis, SERVPRO is here to help. But, why SERVPRO?

24/7 Emergency Service

This is great when you have an emergency. We will get to the scene of the mold and start our process as soon as possible. Our quick response will help to lessen any damage, help avoid costly repairs, and help result in less damage to your family.

Highly-Trained Technicians

When dealing with mold, you need to be aware that only professionals should be handling these matters. Our professionals can handle your mold problem and have credentials from the Institute of Inspection Cleaning and Restoration Certification (IICRC)

#1 in the Cleanup and Restoration Industry

We’ve earned our reputation as a trusted leader in the restoration industry and we specialize in mold inspection and testing, mold cleanup, restoration, and more.

Our Insurance Claims Process

Our insurance claims process is easier and we will help you to navigate the process and coordinate the necessary paperwork for a quicker, easier experience.

In the event of a mold emergency, SERVPRO is always available 24/7.

What to Include in Your Fire Safety Plan

7/26/2022 (Permalink)

- Create a plan for each room

Your fire emergency plan will be different for each room of your home because the exit points are different. Some rooms are on the first floor while some are on the second or third which requires completely different escape routes.

- Have two ways out of each room

It is important that your plan involves two different exits out of the same room. Most people do one exit plan through the door and one exit plan through the window. This is in case one exit is blocked by flames.

- Have yearly family meetings about evacuation plans and practice

Each year, your family should familiarize themselves again with their fire escape plan. Some exit routes may change as the house and landscaping are updated. If your master bedroom's window exit relied on the tree in your front yard that was cut down, you will have to create a new plan for that room.

- Choose a meeting spot after evacuations

Included in your fire escape plan should be a meeting spot for the whole family once everyone escapes from their respective rooms. This can be a local park or just your neighbor's house, but this should be set in advance so you can quickly figure out who may be stuck in the house.

24/7 Emergency Service

24/7 Emergency Service